Приобрети журнал - получи консультацию экспертов

№3(14)(2013)

Since international debt relationships are a major factor in financial instability, Ukraine is to prepare early answers to key challenges of international environment, as Yaroslava Bazyliuk, PhD in economics, is convinced. She shared her views on study of structural parameters, trends and consequences of accumulation of sovereign debt, which now is the urgent task of economists, with readers of our journal.

Continued accumulation of sovereign debt reaching historical highs in developed countries, makes international expert community systematically rethink challenges and threats of financial security. Despite cautious optimism expressed by experts about post-crisis global recovery, there is a belief about long-term problems unloading existing financial imbalances. That is why modern scientific debate in this area is dedicated primarily to a wide range of issues related to peculiarities of accumulation of public debt management and decline in pace of global economic growth.

Today, scientists observed general increase in risk generated by international sovereign finance sector, and accumulation of dangerous potential for sovereign debt sector is considered a trigger reformatting the international financial architecture. However, scientific and applied research on international sovereign debt burden sector does not provide definitive answers to solve debt problems. In this context, relevance of the study is to determine safe parameters for conceptual accumulation of public debt for international and national financial systems, as well as areas of international regulation of such processes.

Ensuring safety of sovereign debt sector remained the most active areas of professional discussions. Multidimensional flow affects the public sector debt issues in other areas, complexity of relevant information on existing and potential risks of accumulation of sovereign debt, identification of safety criteria accumulation of debt for each country and ability of governments to repay debt - that's only a partial list of issues, delay with the solution on which enhances global financial instability.

In general, current state of debt burden of sovereign sector shows a positive trend that accelerated in post-crisis period. Thus, according to IMF estimates in 2009 sovereign debt relatively to global GDP accounted for 76.2%, in 2012 as predicted its level to reach 81.3%, and for 2013 is expected to increase up to 81.5% (Fig. 1). The highest rates of debt accumulation observed in developed countries. Thus, in 2013, it is expected that ratio of public debt to GDP relatively to same indicator in 2009 will grow in Ireland - by 54.4%, Greece - by 52.8%, Spain - by 43.0%, Portugal - by 40.6%, Japan - by 34.8%, UK - by 25.3%, USA - by 22.0%, the euro area – 14,9%. It is assumed that the average accumulation rate debt to GDP for developed economies in 2013 relatively to 2009 will be 18.4%.

It is worth noting that increase in debt burden is on background of reducing budget deficits. Thus, total deficit of all countries, which in 2009 reached 7.4% of world GDP in 2012 is expected to reach 4.2% of GDP and 3.5% of GDP in 2013. This trend corresponds to the followed path of fiscal consolidation, which was actively supported at the national level.

Fastest fiscal consolidation observed in countries that have increased national debt. Specifically, the 2013 budget deficit will amount up to 4.7% of Greece's GDP (in 2009 the figure was 15.6% of GDP), Ireland - 6.4% (13.9% of GDP in 2009), Portugal - 5.7 % of GDP (10.2% of GDP in 2009), Spain - 5.7% of GDP (11.2% of GDP in 2009), the United States - 7.3% of GDP (13.3% of GDP in 2009), the euro area - 2.6% of GDP (6.4% of GDP in 2009).

Unconditional positive achievement according to fiscal discipline and optimizing operating costs achieved as a result of fiscal consolidation. This increase in debt burden shows no improvements in addressing systemic issues - insufficient economic growth to cover debt flows and the lack of mechanisms, including financial, for real debt reduction (mechanism restructuring achieved only postponing debt and, as a rule, general terms of borrowing worsen).

Under these conditions it is difficult to assess safety of global movement to discharge debt problems. If we put Maastricht criteria as the basis for evaluating security burden on sovereign debt sector, a large number of states reached excess of threshold levels of 60% debt to GDP and the budget deficit to 3% of GDP. Thus reducing budget deficit does not support economic growth, which is problematic in post-crisis period. Thus, ratio of debt to GDP can worsen significantly in the medium term.

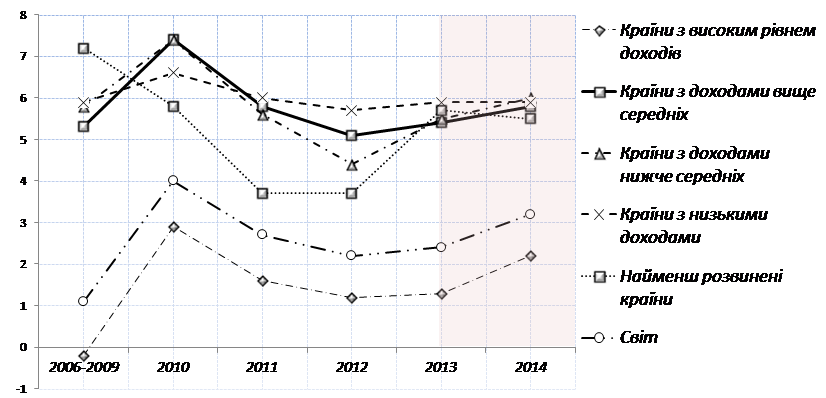

Medium term projections of the IMF, the UN and the World Bank point on the lack of opportunities for economic growth to solve debt problem of sovereign sector. The biggest threat here is high probability of synchronized global recession. Thus, according to basic UN projections, growth of world gross domestic product is expected to reach 2.2% in 2012, 2.4% - in 2013 and 3.2% in 2014 (Fig. 2). Majority of countries will not be able to perform their potential and restore jobs lost during the crisis.

Figure 1. Gross public debt and budget deficits in some countries in 2009-2013 *,% of GDP

* 2012 and 2013 - estimates as of October 2012

Source: Fiscal Monitor. Taking Stock. A Progress Report on Fiscal Adjustment, October 2012 [Електронний ресурс]. – Режим доступу: http://www.imf.org/external/pubs/ft/fm/2012/02/pdf/fm1202.pdf

Ii is important to note synchronizing the decline rate of economic dynamics in countries with different income levels. The key factor is to reduce volatility of global GDP growth in developed countries. Most of them, especially in Europe, are involved in downward trend of economic dynamics as a result of rising unemployment, ongoing reducing crediting for corporate sector and households, maintaining instability in banking system and increasing sovereign risk.

Figure 2. Average annual GDP growth in 2006-2014,%

Source: World Economic Situation and Prospects 2013 - [electronic resource] – Mode of access: http://www.un.org/en/development/desa/policy/wesp/wesp_current/2013Chap1_embargo.pdf

According to IMF forecast from January, in 2013 the rate of global economic growth will amount to 3.5% and the Euro zone - 0.2%. IMF experts expressed cautious optimism about expectations of economic growth, based on analysis of measures taken, which made it possible to remove risk of acute crisis in the Eurozone and the U.S. However, the IMF predicts slow economic recovery for the euro area. Despite onset of recession in Japan, the IMF expects effect from stimulus. Countries with transformation economies are projected to revive economic growth, maintenance of which will depend on ability to overcome weak external demand and internal constraints. Overall, the International Monetary Fund predicts preservation of significant risks deteriorating due to possible problems in the Euro zone and risks of excessive fiscal consolidation in the United States (Table 1).

Table 1

Indicators of real GDP in some countries according to IMF and World Bank predictions in 2013,%

|

Country |

IMF |

World Bank |

Country |

IMF |

World Bank |

|

World, total |

3,5 |

2,4 |

India |

5,9 |

6,1 |

|

USA |

2,0 |

1,9 |

RF |

3,7 |

3,6 |

|

Euro area |

-0,2 |

-0,1 |

Brazil |

3,5 |

3,4 |

|

Japan |

1,2 |

0,8 |

Ukraine* |

3,5 |

0,5 |

|

China |

8,2 |

8,4 |

Sources: 1. МВФ World economic outlook. Gradual Upturn in Global Growth During 2013. [Electronic recourse]. – Mode of access: http://www.imf.org/external/pubs/ft/weo/2013/update/01/index.htm

2. World Bank Global Economic Prospects. Assuring Growth Over the Medium Term January 2013. [Electronic recourse]. – Mode of access: http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1322593305595/8287139-1358278153255/GEP13AFinalFullReport_.pdf

*IMF projections as of November 27, 2012 are taken for Ukraine. Ukraine 2012 Article IV Consultation [electronic resource]. - Access http://www.imf.org/external/pubs/ft/scr/2012/cr12315.pdf

The World Bank predicts that global GDP growth in 2013 will be 2.4%, and expects moderate economic growth over the 2013-2015 years (2014 is expected to grow at 3.1%, in 2015 - 3.3%). For developing countries, this year the World Bank predicts growth of 5.5% (5.7% and 5.8% in 2014 and 2015 respectively), high-income countries - 1.3% (2.0% and 2.3% in 2014 and 2015 respectively). Recognizing emerging economies as main engines of global growth, the World Bank experts, however, stress the slowdown in their economic dynamics that have not yet reached pre-crisis levels, and system needs to improve internal productivity.

In general, the World Bank, like the IMF, indicating that slow growth is a key prerequisite of risk. In this regard, WB forecast observes significant potential of negative impact of the Eurozone to destabilize global development and emphasizes the need for significant improvement in public finances, enhance formation of pan-European banking union funds and sovereign salvation. In case of loss of political initiative in implementing these measures WB predicts a high probability of limiting access of certain Eurozone countries to international capital markets, as well as provoking a global slowdown, which could reduce the GDP of emerging economies by more than one percent.

As a result, it is necessary to study acceleration of financial risks, improve their evaluation and formation of preventive measures. Such work is now intensified by international organizations, national and supranational authorities that work out consistently anti-crisis measures and, importantly, take measures to prevent crisis.

In particular, the International Monetary Fund in post-crisis period significantly increased work of financial supervision, which is under an international mandate and is aimed at ensuring effective functioning of international monetary and financial system and support global economic and financial stability. Here, a positive estimate approved in September 2012, strategy of financial supervision is implemented as primary recommendation of supervisory Triennial Report 2011. It summarizes innovation and financial supervision failures of IMF over the last decade, and also target priorities for its further strengthening.

Importantly, unlike previous concept of surveillance, this strategy focuses on identifying systemic risks of financial stability and macro-prudential policies, and provides tools to enhance political dialogue with national governments in order to reduce probability of financial turmoil globally. In addition, under the IMF's Strategy significantly deepen practical cooperation with the World Bank, the Group of Twenty, the Financial Stability Board and others in regulatory agencies.

An important and relatively new initiative in the field of international risk assessment can serve as an early warning tool (Early Warning Exercise, EWE), established in 2008 after an appeal by a group of twenty to the IMF and the Financial Stability Board. This methodological framework was introduced in 2010. Early warning is prepared in cooperation with the IMF and FSB twice a year and provides for identification unlikely, but the most sensitive risks of global economy, defines action plan to mitigate risks and reduce vulnerabilities and provides guidance to improve further analysis. Feature of early warning is confidential basis of its distribution, as well as recommendations from difference between basic recommendations of IMF reports - World Economic Outlook, Fiscal Monitor, Global Financial Stability Report. In contrast to other reports, early warning enables identification of points of vulnerability and triggers that can cause systemic crisis, and to identify the most appropriate policy directions to reduce risks, including those that require international cooperation.

In the form of collective action to strengthen financial stability and prevent negative phenomena in public finances sector, it should be noted interstate EU agreement - Financial Stability Pact, signed by 25 of 27 EU Member States, which came into force on January 1, 2013. Target of this agreement is to prevent slipping into debt by adhering to fiscal discipline by Member States. The key rules within agreement is to limit public debt to 60% of GDP, maintaining budget deficit within 3% of GDP and structural deficit below 1% of GDP, and introducing automatic adjustment mechanisms which are in the process of development. An important tool for maintaining financial discipline is financial penalties up to 0.1% of GDP for exceeding established norms.

An important tool to research imbalances in the EU is implemented Macroeconomic Imbalance Procedure (MIP) pursuing the Pact, based on the so-called panel. EWS is based on a panel consisting of ten indicators covering the major sources of macroeconomic imbalances. Panel target is to deepen research and identify potential imbalances. Alert Mechanism Report (AMR) for MIP consists of indicator-based panels and presented in annual report. Composition parameters may vary depending on the situation. In addition, the Commission, together with the ECB may introduce an in-depth review.

Of course, these examples are not the only global and national anti-crisis measures taken for recovery of sovereign finance. We only note an important trend - focusing on preventive measures, prediction and crisis prevention.

For Ukraine, under increasing instability of environment, today it is important to ensure effective investigation and prevention of crises, especially those relating to public finances area. Here, a positive estimate was approved in 2010-2012 in programming documents (I mean, first of all, the Ministry of Finance Decree "On Approval of Regulations on management of risks associated with debt» № 461 from 16.06.2010, the CMU Resolution "On approval of control the risks associated with management of public (local) debt” № 815 from 09.01.2012, the Ministry of Finance Decree "On approval of debt management in 2013» № 277 from 21.02.2013). However, complexity and systemic threats of international financial environment necessitate improvement of scientific and applied apparatus to justify decisions to secure the public finances sector.

For this purpose, it is important to prepare measures for diagnosis and early warning of financial imbalances, study the most probable areas and mechanisms for transferring external crises, including debt crisis in the euro area, national economic and financial system, formation of non-debt sources of repayment of public debt, introduction of compensatory mechanisms to finance economy under significant deterioration in foreign markets, optimizing sources of external financing and expanding access to international capital markets, including through development of modern financial mechanisms.

Clearly, the global financial system has accumulated negative potential risks generated by unsatisfactory state of sovereign finances and slow economic growth. It actualizes need of conceptual rethinking the financial stability of Ukraine, accumulation of sovereign debt prospects for economic growth, as well as mechanisms to prevent transfer of financial crisis in national economy.

Головне